Three Pharmacy Benefit Trends to Watch in 2024

February 27, 2024

As we begin another year, several major trends from 2023 will continue to drive key changes in the pharmacy benefit market for health plans and other plan sponsors. In this article, we detail three important trends worth following throughout 2024:

1. New “Transparent” Drug Pricing Models from the Big 3 PBMs

Reform efforts driven by multiple committees across Federal and State legislatures have uniformly called for greater transparency from pharmacy benefit managers (PBMs). With companies like Mark Cuban Cost Plus Drug Company beginning to bring transparent, simple to understand drug pricing models to market, the pressure for PBMs to offer greater transparency in pricing has only increased. In the past 12 months, the Big 3 PBMs have turned their sights toward addressing these concerns head on by introducing their own “transparent” drug pricing models:

- Price Edge by OptumRx launched in January 2023

- ClearCareRx by Express Scripts announced in April 2023 (launched in January 2024)

- CostVantage by CVS announced in December 2023 (anticipated launch in 2025)

Below we provide a brief overview and some key considerations for plan sponsors as they evaluate these attempts to provide greater pricing transparency in pharmacy:

Optum Rx: Price Edge

Price Edge is designed to integrate direct-to-consumer pricing comparisons within insurance frameworks to identify the lowest price for the member. In addition, purchases within this program will count towards a member’s out-of-pocket maximum. From a clinical perspective, plans will likely have increased visibility on their member’s prescriptions, reducing the likelihood of contraindications or drug interactions from impacting a member obtaining medications outside their plan’s benefit. While the program is expected to provide members a lower price than most direct-to-consumer options, an important consideration for plan sponsors to keep in mind is the impact these claims will have on existing contract guarantees.

If claims adjudicated under this classification are included in the Generic Effective Rate (GER) calculations, it may lower costs for some members, but raise costs for others. Without the proper inclusion or exclusion criteria for these new claim types, PBMs will manage to the previously agreed upon aggregate guarantees, which could result in a net neutral impact for plan sponsors.

Express Scripts: ClearCareRx™

Another program aimed at increasing pricing transparency is Express Scripts’ ClearCareRx™ program announced in April 2023. This program is designed to provide cost-based pricing for prescription drugs and pharmacy services. The model consists of a lesser-of-logic between the following prices:

- The National Average Drug Acquisition Cost (NADAC)

- The Manufacturer’s Wholesale Acquisition Cost (WAC) or list price and

- Predictive Acquisition Cost (PAC)

Pharmacies will receive a flat dispensing fee along with a portion of a fee (up to 15%) of one of the three prices listed above. These prescriptions will also be exempt from maximum allowable cost (MAC) reimbursement limits.

While the lesser-of-logic pricing model provides clarity on how prices will be calculated, there are still some unknowns that could negatively impact plan sponsors. Specifically, how will the 15% fee be divided between the pharmacy and Express Scripts? Moreover, if generics adjudicated under this program do not have a NADAC or PAC-based price, would Express Scripts adjudicate at WAC or the pharmacy’s submitted usual and customary (U&C) price? Generally, both WAC and the pharmacy U&C are significantly higher than NADAC and other negotiated reimbursement rates, which may result in plan sponsors paying more than they would without the program. While it is important to provide greater pricing clarity in the pharmacy benefit, it’s possible plan sponsors could end up paying more than anticipated for certain products.

CVS CostVantage

Finally, in December 2023 CVS Health announced their plans to implement more transparent pricing programs for their commercial payers starting in 2025. The CostVantage program aims to define drug costs and reimbursement using a transparent formula founded upon the cost of a drug (acquisition cost) multiplied by a fixed percentage markup, and an additional fee to reflect the value of pharmacy provided services. This acquisition cost calculation will be applied to both CVS and non-CVS pharmacies. While the full details have not yet been released, CVS said the markup percentage for each drug will be negotiated on an individual payer basis.

While this model intends to drive transparency and lower costs, there are some potential hurdles that could ultimately decrease efficiency and increase prescription spend. For example, if pharmacies are contractually obligated to receive a margin above their cost, their incentive to find the lowest acquisition cost diminishes. Also, with the markup percentage being open to negotiation on a payer-by-payer basis, it is possible the system will look very similar to the current state in which prices for the same drug can vary dramatically between plan sponsors.

Finally, the pharmacy acquisition cost will be determined by a CVS calculated acquisition cost index. While clients will have some transparency into the calculation through audit rights, it will likely be difficult for plan sponsors to gain full access to the calculations determining acquisition cost in a timely manner. Traditional pharmacy benefit audits often lag 6-12 months following the close of the plan year creating substantial delays in the time to conduct proper analysis. It is possible similar lags could exist in this area as well.

2. Adoption of Biosimilars

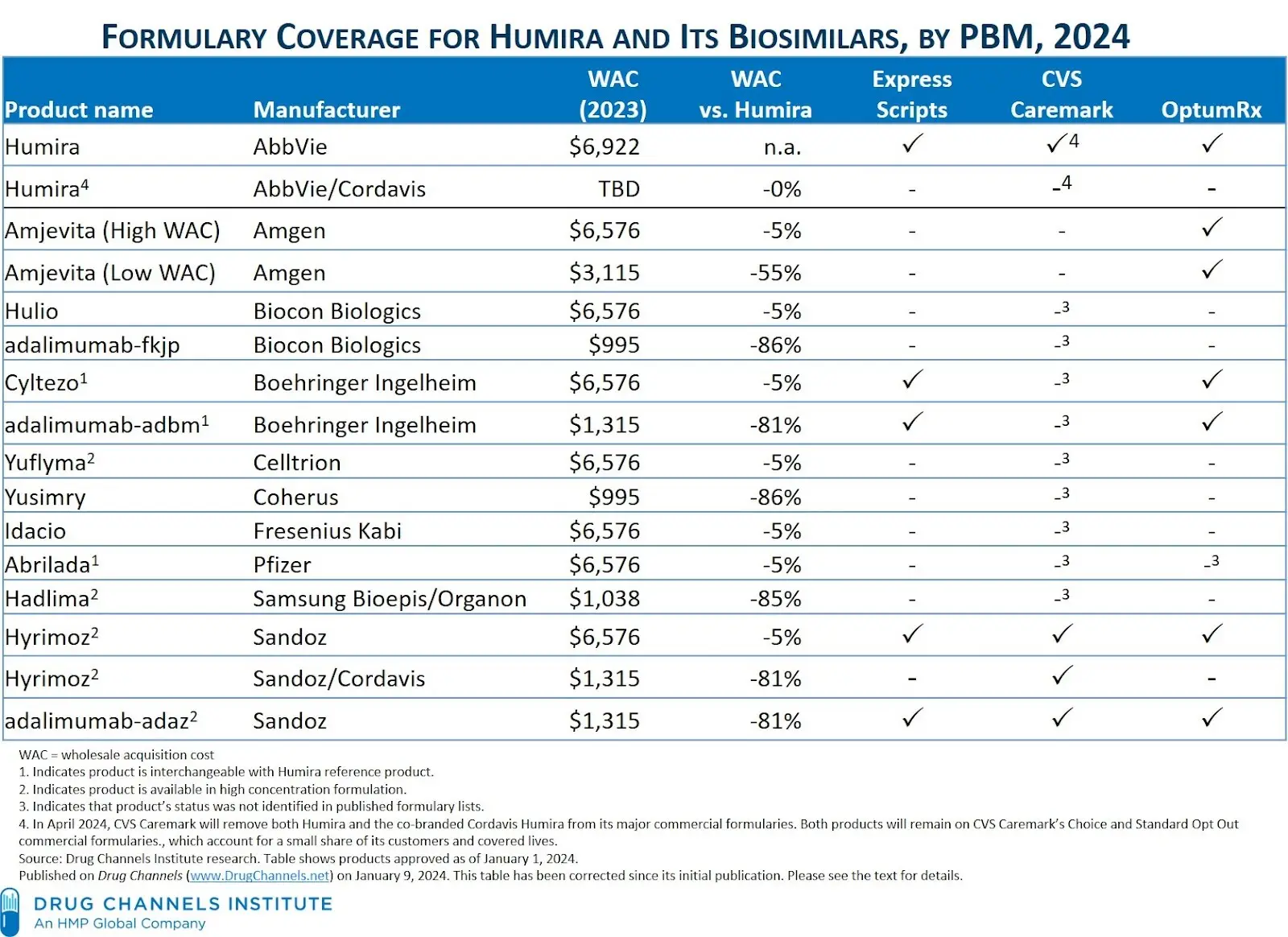

As we move into 2024, attention continues to remain on the growing prevalence of biosimilar products, especially with the explosion of biosimilars available for the blockbuster rheumatology drug, Humira. In a recent report published by IQVIA, biosimilars are projected to save up to $180B from 2023 – 2027. In a recent press release, CVS Caremark projects the U.S. biosimilar market to grow from less than $10 billion in 2022 to more than $100 billion by 2029. As the availability and prevalence of biosimilars continues to grow, formulary management and utilization strategies from the Big 3 PBMs will be a key area of focus and essential to helping plan sponsors realize the savings promise of biosimilar products. The table below compiled by The Drug Channels Institute shows the complex environment for just biosimilar products referencing Humira.

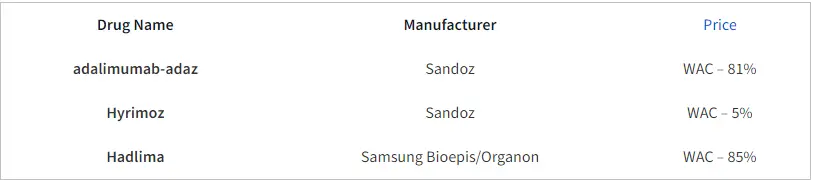

Of note, CVS Caremark recently announced the removal of Humira from major national commercial formularies, effective April 1, 2024. Instead, they will be preferring a mix of 3 biosimilars across their formularies (adalimumab-adaz, Hyrimoz, and Hadlima). The pricing strategies for these products reflect two distinct categories. High WAC/high rebates and low WAC/low (or no) rebates.

As plan sponsors navigate the shifting Humira and broader biosimilar landscape, there are a few considerations that should be taken into account. While low net cost biosimilars offer decreased upfront spending compared to branded Humira, the impact on rebates will likely be substantial. With many plan sponsors in the U.S. relying heavily on rebated drugs, this change will certainly influence overall budget forecasting and rebate recoveries at the end of the year. As one of the most utilized and highest revenue grossing drugs of all time, this will likely result in some degree of member disruption. For members currently on branded Humira, it may be in the best interest of plan to consider switching therapies to a more cost-effective option, but ultimately the choice will depend on a robust analysis between lower upfront spending versus the overall impact of lower rebates.

3. Management of GLP-1 Medications for Obesity

A recent white paper by Milliman focuses on describing payer strategies for the management and coverage of GLP-1 medications, a class of drugs showing effectiveness in treating obesity. However, due to their high cost and potential gastrointestinal side effects, GLP-1s pose challenges to medication adherence and continued therapy, with over 68% of patients discontinuing use within 12 months.

Patient demand and subsequent utilization of these drugs has continued to skyrocket over the last two years and have presented plan sponsors with very important clinical, economic, regulatory, and patient engagement considerations. While this increase in utilization will change the landscape of payer economics, it will undoubtedly increase profits for PBMs.

As we look to 2024 and beyond, payers will continue to be faced with the challenge of balancing coverage options for these costly medications that may also hold the promise of greatly reducing obesity-related medical expenses.

Given the significant financial implications of GLP-1s, this paper underscores the importance of implementing a robust care management framework to support patients using GLP-1 medications while limiting potential waste in prescription benefit spending. Recommendations include creating educational programs, providing engagement and support for behavioral change, and addressing potential socioeconomic inequities that may affect treatment access. GLP-1 medications offer promise for addressing obesity and other obesity-related comorbidities but require careful strategic management by payers to ensure clinical effectiveness and economic efficiency.

Conclusion

2024 will represent a pharmacy market characterized by turning points and change. We expect to continue seeing new PBM-driven efforts to drive innovation in transparency and pricing models, biosimilars entering the retail market for additional high-cost, high-rebate products, and the rapid growth of GLP-1 utilization. The importance of managed care pharmacy has never been greater given the cost implications of each of these major trends. Health plans will be required to navigate these challenging dynamics, adapt to new trends, and ensure sustainable approaches can be found to balance the economic and clinical outcomes of their members.

Interested in how technology paired with industry leading pharmacy benefit expertise can help you prepare and manage these key trends? Visit us at hds-rx.com to learn more about how pharmacy benefit payment integrity can help you stay ahead of the curve or connect with one of our business development representatives to schedule an introduction.

Sources

- https://www.drugchannels.net/2023/12/what-cvs-pharmacys-new-cost-plus.html

- https://www.drugchannels.net/2024/01/the-big-three-pbms-2024-formulary.html

- https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/long-term-market-sustainability-for-infused-biosimilars-in-the-us/iqvia-us-biosimilars-sustainability-01-2024-forweb.pdf

- https://www.fiercehealthcare.com/payers/optum-rolls-out-new-tool-automatically-offers-members-lowest-generic-price

- https://www.pharmexec.com/view/express-scripts-to-launch-new-network-option-with-simpler-drug-pricing-structure

- https://www.milliman.com/-/media/milliman/pdfs/2023-articles/8-28-23_glp-1s-for-weight-loss_20230824.ashx