Case Study

State Employee Health Plan Drives Savings Using Continuous Pharmacy Claims Monitoring

At a Glance:

HealthPlan Data Solutions (HDS) was selected by the leadership team of a state employee health plan representing nearly 300,000 covered lives to establish an industry leading pharmacy payment integrity program. HDS implemented their proprietary ongoing monitoring solution, Claim Scan, to review 100% of this client’s pharmacy claims in real-time. After the first year of implementation, this state employee health plan was able to realize nearly $1.4 million in pharmacy benefit savings ($0.39/PMPM), as well as highlight several areas to strengthen their PBM contract. Most importantly, HDS helped this client return nearly $100,000 to members because of incorrectly calculated copayments.

Background & Situation

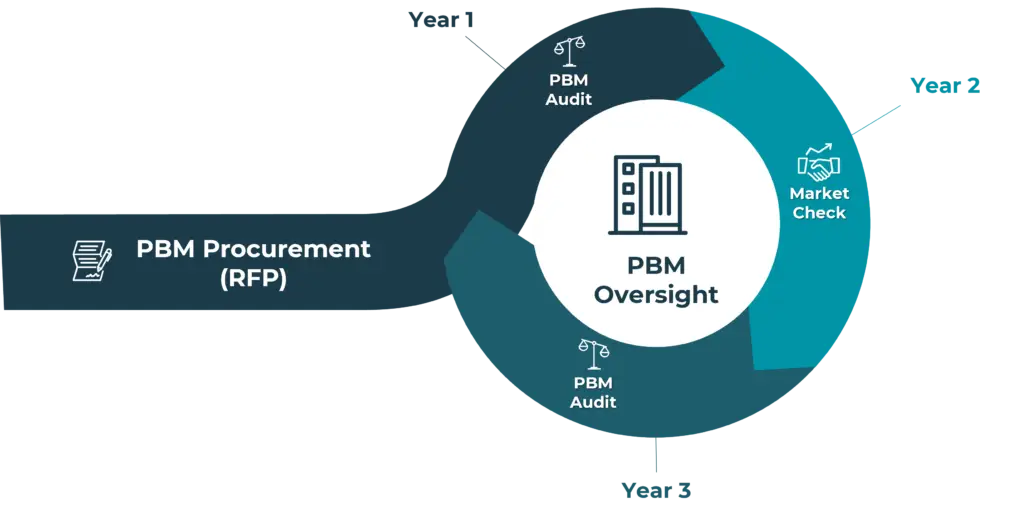

As pharmacy benefit spending continues to rise in aggregate, many state legislatures across the nation are beginning to push for greater transparency and accountability from both PBMs and their state’s plan sponsors. Following newly implemented legislation mandating greater PBM oversight in this client’s home state, HDS was selected through a competitive RFP process to implement independent, third-party monitoring for all pharmacy benefit claims in their public employee health insurance program.

Before engaging with HDS, this client used annual PBM audits as their primary lever for pharmacy benefit payment integrity in addition to conducting RFPs for PBM services through multi-year contract cycles.

Solutions & Results

After being awarded this contract, HDS worked directly with the plan sponsor’s leadership team to begin securely ingesting their ongoing pharmacy claims files while simultaneously coding their unique plan design and PBM contracts into Claim Scan. Claim Scan leverages a plan sponsor’s data to conduct a 100% review of pharmacy claims against up to 600 proprietary claim scanning algorithms designed to identify:

-

Plan Design Errors

-

Reimbursement Reviews

-

Savings Opportunities

-

Contract Administration Errors

-

Regulatory or Claim Fill Errors

-

Claims Needing Audit Review

Following setup, HDS’s clinical analytics and account management team established weekly meetings to calibrate findings and review initial results with the client. With Claim Scan’s claim-level results in hand, HDS was able to highlight several issues for immediate review with the client’s PBM.

One issue of particular concern flagged by Claim Scan was over 17,000 claims being adjudicated at a price above the pharmacy’s usual and customary price (U&C). Normally a pharmacy’s U&C price is their highest price adjudicated for cash claims processed outside of 3rd party insurance. Claim Scan was able to detect a large volume of claims for this client adjudicating above U&C. Upon further analysis, HDS analysts discovered that the U&C price had been excluded from the plan’s contracted lesser-of-logic during set up at the beginning of the plan year.

HDS immediately provided a claim-level impact report for the client’s PBM and started the resolution process. Ultimately, this resolution led to a more than $900,000 service warranty and nearly $200,000 in additional avoided costs for the client.

17,000+ Claims Adjudicated Above the Pharmacy U&C Price & Were Incorrectly Included in the Plan’s Lesser-Of-Logic.

Savings: $1.1 Million

Another important issue flagged by Claim Scan involved a small subset of specialty claims. Claim Scan identified 23 claims dispensed at specialty pharmacies where the calculated discount rate did not match the contracted discount rate. While often representing less than 2% of total claims, specialty drug claims account for a significant portion of total spend. As a result, HDS was able to work directly with the PBM to correct the discount issue and recover over $250,000 for the client.

23 Claims Were Dispensed at Incorrect Specialty Discount Rates

Savings: $250,000

Conclusion

By working with HDS to implement Claim Scan ongoing monitoring, this state employee health plan was able to greatly enhance their pharmacy benefit payment integrity process. In total, Claim Scan was able to deliver over $1 million in hard dollar recoveries and an additional $400,000 in total avoided costs in just one plan year.

Beyond cost recoveries, Claim Scan and HDS’s team of industry leading claims analysts also worked with this client to strengthen several aspects of their PBM contract regarding 340b claims identification, high-cost compounded drugs, and covered multi-source branded drugs.

The HDS team is dedicated to helping our clients maximize the value of their current contract and providing opportunities to strengthen their pharmacy benefit over time. HDS is proud to be a leading force helping clients drive greater transparency and accountability with their pharmacy benefit managers.